Table of Content

However, HELOCs are secured loans that are backed by your property, so they tend to affect your credit score less because they're treated more like a car loan or mortgage by credit-scoring algorithms. Offers you a lump sum of cash that you borrow against the equity built in your house. Our ratings take into account interest rates, lender fees, loan types, discounts, accessibility, borrower requirements and other attributes.

Home equity loan options let homeowners leverage the equity in their homes to borrow money. It’s a great way to fund your home improvement projects, pay off credit card balances or consolidate debt, with a single payment and a lower interest rate. Suncoast Credit Union has an average approval rate when compared to the average across all lenders. They have a below average pick rate when compared to similar lenders. Suncoast Credit Union is typically a low fee lender. (We use the term "fees" to include things like closing costs and other costs incurred by borrowers-- whether they are paid out of pocket or rolled into the loan.) They typically have about average rates.

More mortgage rates:

Payment based on a $10,515 loan with an Annual Percentage Rate of 3.50% for a 25-year term. Mortgage insurance premiums pay for insurance to protect mortgage lenders against borrowers’ risk of not paying them back. Whether you’re saving for college or saving for retirement, or trying to pay your debts, Suncoast has calculators to assist you to strategize for a financially safe future. Along with saving thousands of dollars based on interest, you’ll also face savings with lower closing costs and fees during the mortgage process. The reason why you might choose working with a credit union to obtain your mortgage starts before a mortgage rate is even defined.

Suncoast Credit Union offers both regular and jumbo CDs that typically offer APYs higher than the national average. Regular CDs require an opening deposit of at least $500, while the minimum for jumbo CDs is $100,000. Suncoast Credit Union’s money market account earns a higher yield for balances that exceed $1,000. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Home Equity Loan Options

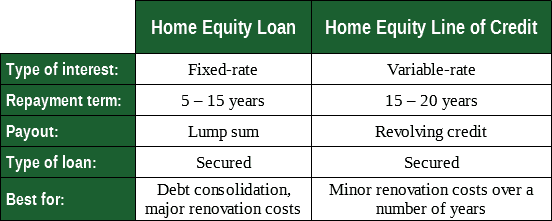

Consult a tax advisor regarding the deductibility of interest. Home Equity 5 YearsCompetitive interest rates and flexible terms. Equity Line of CreditCompetitive interest rates and flexible terms. To apply for a loan or to open a new account, select the Open and Apply option once logged in.

If you would like to contact us, please do so from our Contact Us page. To change the mortgage product or the loan amount use the search box above. Suncoast Credit Union is Florida’s largest credit union and ranks ninth among U.S. credit unions with some 930,000 members.

A home equity loan is better if:

Object moved this document may be found here Home improvement secured 10 year. Use this calculator to decide how much monthly income your retirement savings may offer you in your retirement. Make Use Of this calculator see what it will take to pay off your credit card balance, and what you can modify to meet your repayment goals.

If you responded “yes” to any of the preceding questions, tapping out the equity in your home to pay off consumer debt may be a short-term solution that can put your home in jeopardy of foreclosure. Check today's rates at the Suncoast Online Mortgage Center. We offer homeowner’s, title, private mortgage, flood, windstorm and interior condominium insurance plans. Up to 80% loan-to-value available for qualified borrowers. Up to maximum 100% loan-to-value available for qualified borrowers.

Best For Lowest Starting Rate

To calculate your home equity, subtract your remaining mortgage balance from the current appraised value of your home. How much equity a bank or lender will let you take out depends on a number of additional factors such as your credit score, income and DTI ratio. For most homeowners, it can take five to 10 years of mortgage payments to build up enough tappable equity to borrow against.

Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners.

Today, however, there's less risk of your home's value decreasing below your home equity loan amount. Home prices have appreciated more than 40% across the US since the beginning of the pandemic, and it seems unlikely that they'll go down in a significant way anytime soon. Alix is a staff writer for CNET Money where she focuses on real estate, housing and the mortgage industry.

Refinancing can be good if you’re experiencing home improvement or debt consolidation, or if you intend to lower your monthly payment. If you’re currently a member of a credit union, they have access to your financial data, so there’s often less information that needs to be given during the application. This often leads to a more convenient and quicker approval process. For example, if your home is worth $450,000 and you owe $250,000 on your loan, you would refinance for the entire $450,000, rather than the amount you owe on your mortgage.

LTV's from 80.01% - 100% may qualify for our High LTV (Loan-To-Value) Home Equity product. Rate will be higher than standard Home Equity product. LTV's from 80.01% - 100% may qualify for our High LTV Equity Line of Credit product. Rate will be higher than the standard Equity Line of Credit.

No comments:

Post a Comment